Budapest is not only a breathtaking capital city but an attractive market for Real Estate investors. Nowadays, Budapest is frequently referred to as the ”Paris of Eastern Europe”. Indeed, the city has a truly charming and exciting atmosphere - with the river Danube, beautiful bridges, old cafés, unique ruin pubs, and spectacular architecture - which attracts more and more visitors.

Being located in the centre of Europe makes it very popular among both tourists and foreign students. Budapest has several universities, most of the locals speak English and the city is inexpensive compared to Western European cities. This is also why many foreign students choose it for their exchange semesters or even for their whole studies. Especially medicine and vetinary students decide to complete all their university studies in Budapest, often renting the same apartment for 5-6 years. It is possible to make very good rental yields in the center of Budapest and, because of the reasons mentioned above, the rental demand is increasing.

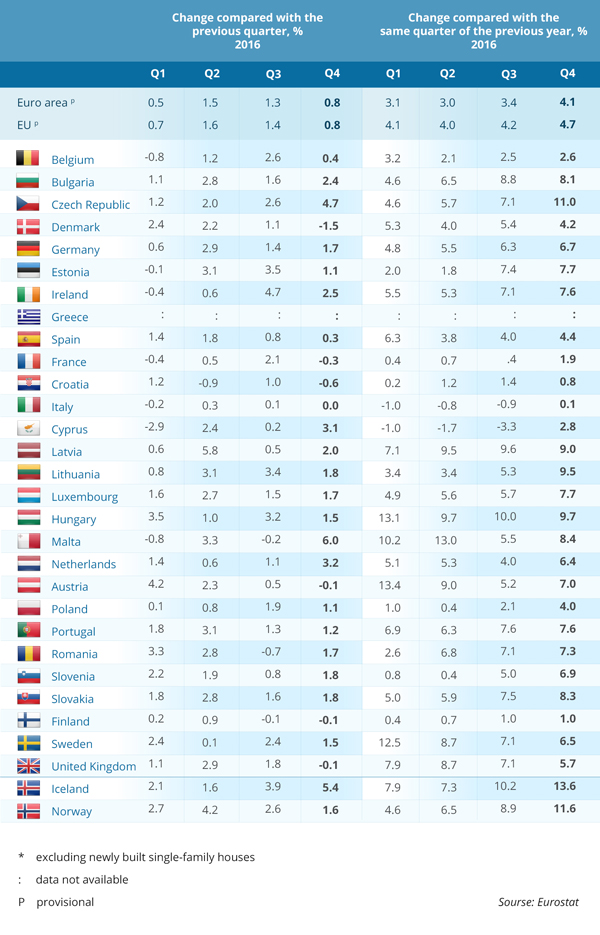

Residential property prices rose significantly in the last few years in Budapest after reaching the lowest point caused by the global financial crisis in 2008. According to the statistics of Eurostat1 the HPI (house price index, which shows the annual price changes in per cent in the first table below) was negative in Hungary from the start of the crisis in 2008 until 2013, it became positive in 2014 and prices grew with over 11% in 2015.

The second table below shows that prices in Hungary rose over 10% again from 2015 to 2016.

This increase is remarkable compared to the changes in other European countries. Prices are still expected to rise in the near future2.

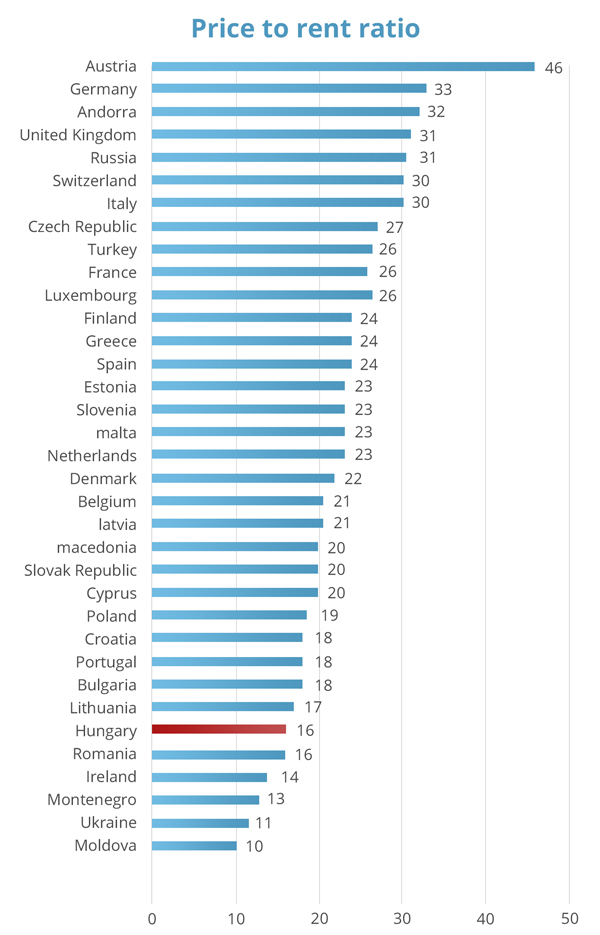

Not only purchase prices but rental prices jumped recently in Budapest. This has been caused partly because short-term rental popularity and partly because of the constant demand of long-term rentals. Besides the great number of students, a high proportion of young Hungarians rent instead of buying because they cannot afford to buy their own property. In 2015 rental prices jumped 20-40%. By 2017, price growth stopped and it is not likely to go up. As it stopped at a high level, even without rising it is quite favorable for investors. It is still easy to acheive 8% gross yield with long-term rentals and up to 20% gross yield with short-term rentals. With experience and local knowledge, it is also possible to reach gross long-term yields as high as 10%. Price to rent ratio is also a good indicator of profitable investments. It shows how many years it takes to earn the purchase price of a property by renting. The following graph shows that Hungary is in a very favourable position in this respect compared to other, mostly European, countries.

As mentioned above it is possible to push the average 8% gross long-term yields up to 10%. The only challenge is having expertise and experience in Real Estate investments and a thorough knowledge of the local area. There are upcoming areas and good opportunities which offer good yields immediately and capital gain on the long run. We advise you to register on our website because finding these deals and using them in best possible way to give you the highest returns is exactly what the team of RealtyBundles is doing, with experts having many years of experience behind them.

Sources